- Mar 07, 2021 ISO 31000 is an international standard published in 2009 that provides principles and guidelines for effective risk management. It outlines a generic approach to risk management, which can be applied to different types of risks (financial, safety, project risks) and used by any type of organization.

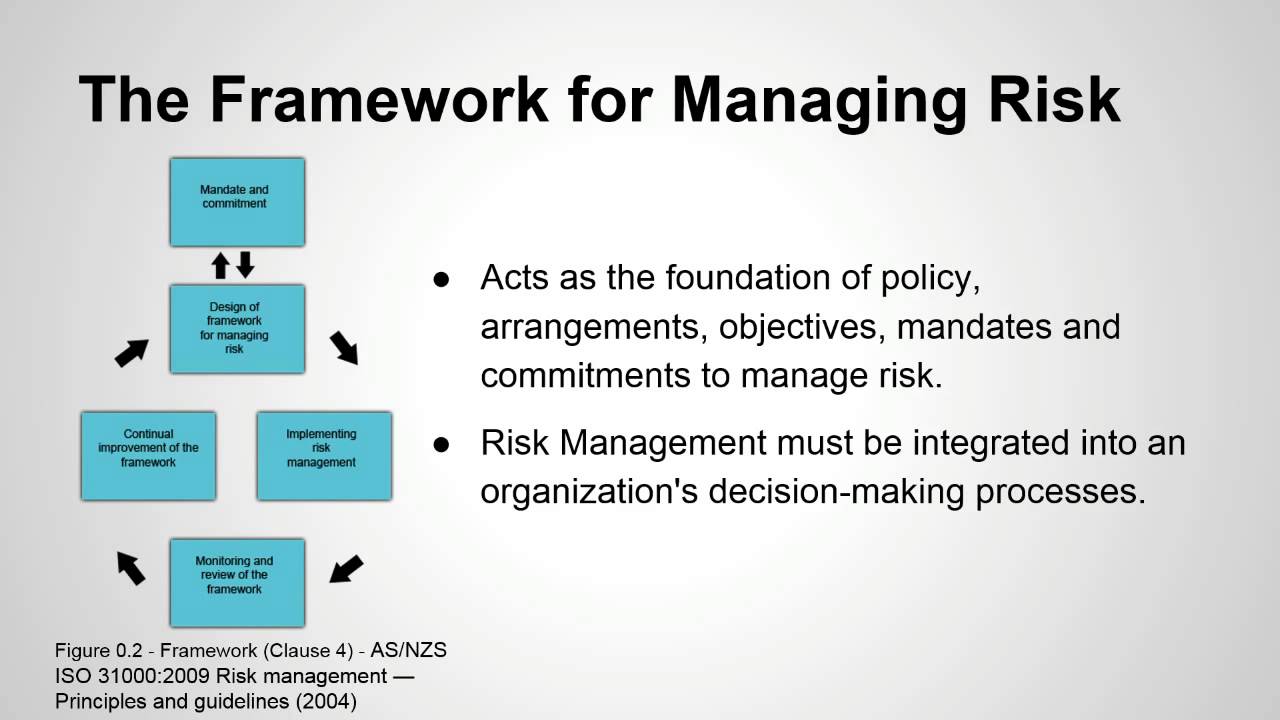

- The ISO 31000 underlines the development of a framework that will fully integrate the risk management process into an organization. The framework assures that an organization-wide process is supported, iterative and effective. That means that risk management will be an active component in governance, strategy and planning, management reporting.

- ISO Risk management – Guidelines. To learn which documents are needed to develop a Business Continuity Management System, download this free white paper: Checklist of ISO mandatory documentation. Checklist of ISO mandatory documentation. Free white paper that explains which documents to use and how to.

Make sure your strategy directs and contributes to providing a comprehensive set of ERM tools, practices and policies to analyze and report enterprise risks, including the analytical, systems and data management capabilities to support the risk management programs; consolidating and integrating ERM tools and functions (policies, control documentation, assessments, metric reporting); and implementing a set of risk metrics and reports.

Risk management framework, and a risk management process. Risk management framework. According to ISO 31000, a risk management framework is a set of components that support and sustain risk management throughout an organization.

Benefits

- Avoid, eliminate or mitigate risks.

- Create a good risk culture.

- Develop an Enterprise Risk Management program.

- Plan on staying ahead of your competition.

- Mitigate insider risk.

- Measure and quantify risk.

- Maximize shareholder value and returns.

- Develop your purpose and expected outcome.

- Know you are in compliance.

- Adjust your supply chain to market changes.

Summary

The Art of Service has identified hundreds of ISO 31000 Risk Management critical capabilities and use cases to assess and compare, or prepare for, your assessment results. Leaders should select a result that best aligns with their business needs before implementing a solution.

The Art of Service's Critical Capabilities evaluates hundreds of results to help with the outcome selection process.

This Critical Capabilities report will enable leaders to shortlist hundreds of appropriate results across the seven RDMAICS typical use cases, this research will help guide leaders' choices.

This Analysis will help you plan your ISO 31000 Risk Management roadmap.

Iso 31000 Risk Management Standard

Overview

What You Need to Know

Analysis:

- Recognize results

- Define results

- Measure results

- Analyze results

- Improve results

- Control results

- Sustain results

The Art of Service Methodology

We’ve translated ISO 31000 risk management definitions Communication and consultation - Consequence - Context - Control - Event |

Iso 31000 Risk Management Summary

Communication and consultationCommunication and consultation is a dialogue between an organization and its stakeholders. This dialogue is both continual and iterative. It is a two-way process |

ConsequenceA consequence is the outcome of an event and has an effect on objectives. |

ContextTo establish the context means to define the external and internal An organization’s external context includes its external stakeholders, An organization’s internal context includes its internal stakeholders, |

ControlA control is any measure or action that modifies or regulates risk. Controls |

EventAn event could be one occurrence, several occurrences, or even a nonoccurrence Events always have causes and usually have consequences. Events without |

External contextAn organization’s external context includes all of the external environmental |

Internal contextAn organization’s internal context includes all of the internal environmental Governance includes the organization’s structure, policies, objectives, roles, |

Level of riskThe level of risk is its magnitude. It is estimated by considering and combining Common level of risk categories include the following: extreme risk, high risk, moderate risk, and low risk. Of course, you need to define each category so that |

LikelihoodLikelihood is the chance that something might happen. Likelihood can |

MonitoringTo monitor means to supervise and to continually check and critically observe. |

Residual riskResidual risk is the risk left over after you’ve implemented a risk treatment |

ReviewA review is an activity. Review activities are carried out in order to determine In general, ISO 31000 2018 expects you to review your risk management |

RiskAccording to ISO 31000, risk is the “effect of uncertainty on objectives” ISO 31000 recognizes that all of us operate in an uncertain world. Whenever The traditional definition of risk combines three elements: it starts with a While ISO 31000 defines risk in a new and unusual way, the old and ISO provides a conceptual definition of risk while the traditional |

Risk analysisRisk analysis is a process that is used to understand the nature, sources, |

Risk assessmentRisk assessment is a process that is made up of three separate Risk identification is a process that is used to find, recognize, and Risk analysis is a process that is used to understand the nature, Risk evaluation is a process that is used to compare risk analysis |

Risk attitudeAn organization’s risk attitude defines its general approach to risk. An |

Risk criteriaRisk criteria are terms of reference and are used to evaluate the significance |

Risk evaluationRisk evaluation is a process that is used to compare risk analysis results |

Risk identificationRisk identification is a process that involves finding, recognizing, and describing |

Risk managementRisk management refers to a coordinated set of activities and methods The term risk management also refers to the programme that is used to |

Risk management frameworkAccording to ISO 31000, a risk management framework is a set of components Foundations include your risk management policy, objectives, mandate, and |

Risk management planAn organization’s risk management plan describes how it intends to manage |

Risk management policyA policy statement defines a general commitment, direction, or intention. |

Risk management processAccording to ISO 31000, a risk management process systematically applies |

Risk ownerA risk owner is a person or entity that has been given the authority |

Risk profileA risk profile is a written description of a set of risks. A risk profile can |

Risk sourceA risk source has the intrinsic potential to give rise to risk. A risk source |

Risk treatmentRisk treatment is a risk modification process. It involves selecting and You have many treatment options. You can avoid the risk, you can |

StakeholderA stakeholder is a person or an organization that can affect or be affected |

Comments are closed.